5 Retirement Mistakes To Avoid

Businessman and Author, Roy H. Williams is quoted as saying, “A smart man makes a mistake, learns from it, and never makes that mistake again. But a wise man finds a smart man and learns from him how to avoid the mistake altogether.” Hopefully by the end of this episode what I share will be deemed as smart and what you do with it will prove you to be WISE!

Hi everyone, welcome back to our channel! Today, we’re going to talk about a very important topic – retirement planning. It’s a complex process, and all of us are subject to make mistakes along the way. In this video, we’ll explore some of the most common pitfalls to avoid, helping you set yourself up for a comfortable and financially secure future.

1: The Importance of Early Planning Starting early gives you time to compound your savings. The earlier you start, the more time your money has to grow. Early planning also allows you to adjust your strategy as needed, helping you avoid making rushed decisions due to time constraints.

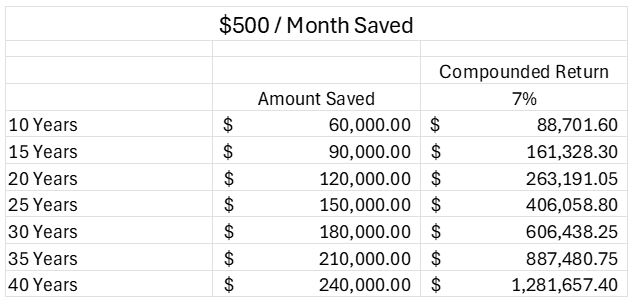

Consider the power of compounding your returns with more time by looking at these numbers. If you were to invest $500 per month for 10 years and were able to average 7% annually on these savings, you’d have turned your $60,000 ($6,000/year for 10 years) into $88,700. Any of us would be happy to have the extra $22,000 to use 10 years later. But check this out… saving the same $500/month for an extra 5 years would turn $90,000 saved into $161,300! The extra $30 Grand saved with the benefit of time (5 years) resulted in nearly $73,000 more in savings. Maybe you have more than 10 or 15 years in front of you to save, reflect on the staggering effect of compounding your returns with more time.

2: Underestimating Expenses One of the biggest mistakes people make is underestimating their expenses. Unexpected medical costs can significantly impact your retirement funds. Inflation can erode the purchasing power of your savings over time, and lifestyle changes can lead to unforeseen expenses. It’s crucial to plan for these potential costs.

A Fidelity Investments study from 2024 showed that Americans significantly underestimate how much healthcare will cost throughout their retirement. The study showed that Americans anticipate healthcare spending from age 65 through the end of their life to total $75,000, but a more realistic expectation needs to be more than double that, $165,000. Putting a 3% inflation rate on that expense would mean that a 55 year old needs to be thinking about planning for a total expense closer to $225,000 per person. The difference between $75,000 and $165,000, much less $225,000 is more than a rounding error, such that underestimating expenses can be a big mistake.

3: Ignoring Investment Risk Another common mistake is ignoring investment risk. Some of the things you’ve likely heard before from folks like me may include:

- Don’t put all your eggs in one basket – diversify your portfolio.

- Understand your risk tolerance and choose investments accordingly.

- Be aware of the potential for market fluctuations and plan accordingly.

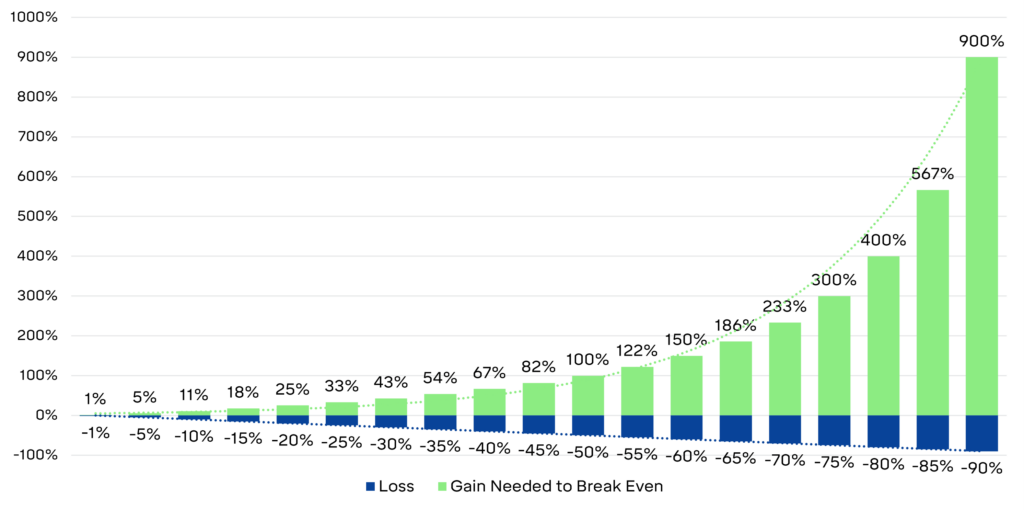

I have certainly said these things myself to clients, and will continue to do so. BUT… What they mean, and how are they measured within YOUR unique plan… well that varies greatly. Spend a little time studying this chart which introduces the idea of Volatility Drag. What you see is as investment losses grow in size the gain needed on that investment to get back to break even grows exponentially. You can plainly understand the uniqueness of circumstances when considering that 27 year old, faithfully contributing to her 401(k) account losing 30% in the midst of a bad market will have an entirely different outcome than the 65 year old losing the same 30%, in the same market, but who is distributing income from his retirement portfolio. Ignoring Investment Risk, or not having a defined risk management plan, is clearly a mistake.

4: Not Seeking Professional Advice Many people try to navigate retirement planning on their own, but seeking professional advice can be incredibly beneficial. A financial advisor can help create a personalized plan for you, provide insights into tax implications and investment strategies, and help you avoid costly mistakes.

Call me self-serving, or biased, to suggest avoiding a professional a mistake. I get it. But given that I don’t know what I’m looking at when I pop the hood on my truck, I know I need a mechanic. There is no shame in not understanding the intricacies of investing, especially when trying to incorporate them into the context of using them as the financial engine to fund your future obligations, goals and dreams.

5: Taking Action and Staying On Track Finally, it’s important to take action and stay on track. Review your plan regularly and adjust as needed. Consider using a retirement calculator to estimate your needs. And don’t be afraid to seek help if you need it.

I’m reminded of the great quote on maintaining personal accountability… “We can’t expect what we don’t inspect.” Whether it be regularly tracking your spending or staying on top of how your savings and investment assumptions from five years ago have performed (behind, on track, exceed) a regular pace of benchmarking where you against your planned numbers is critical. If you have a hard time doing that yourself, or don’t know how to measure it to your desired degree of comfort reach out to our team to assist you.

Remember, retirement planning is a journey, and avoiding these common mistakes can help you achieve a financially secure future. If you have any questions or need further advice, feel free to leave a comment below. Don’t forget to like, share, and subscribe for more tips on financial planning. See you in the next video.