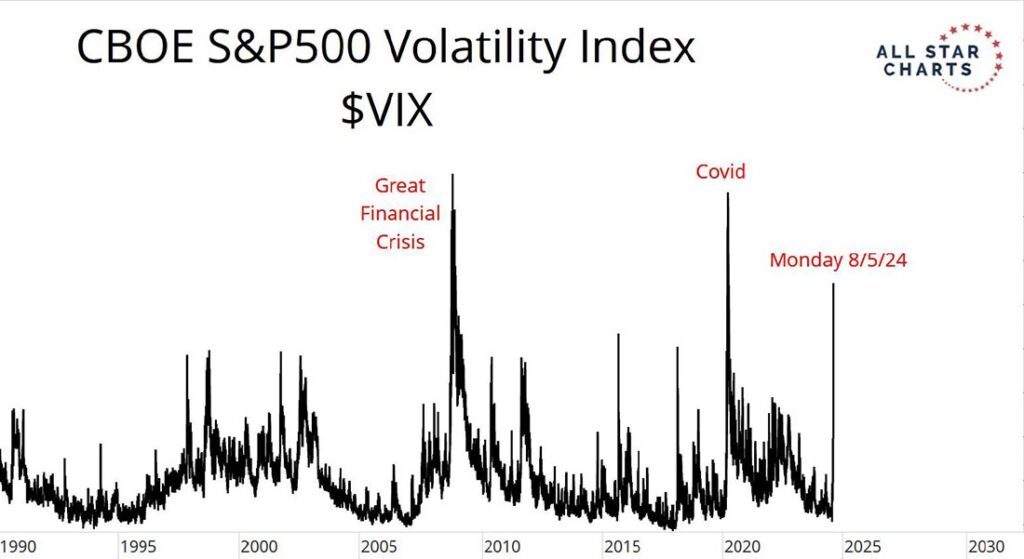

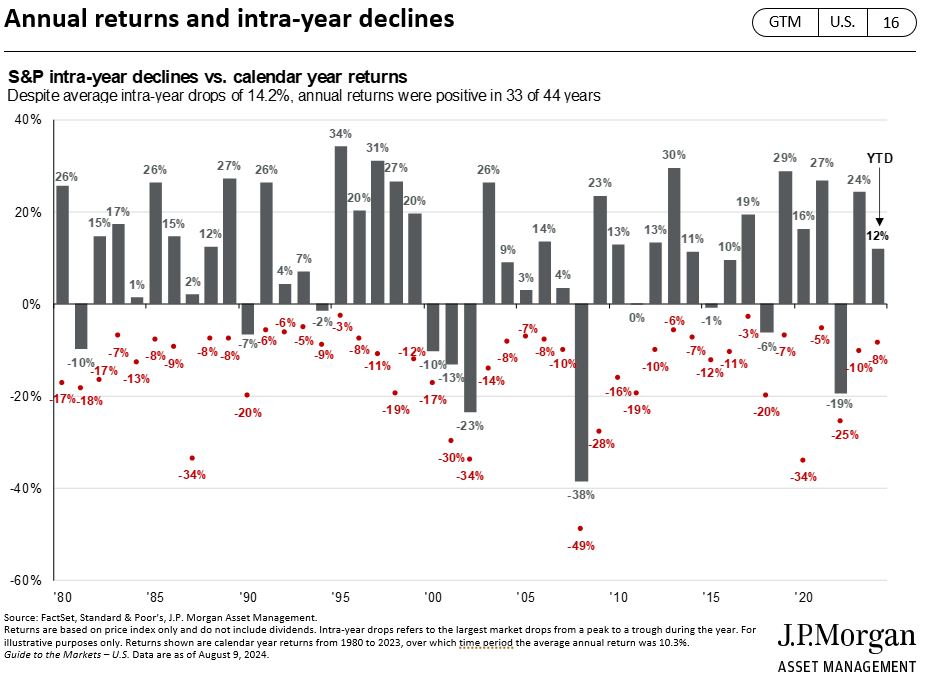

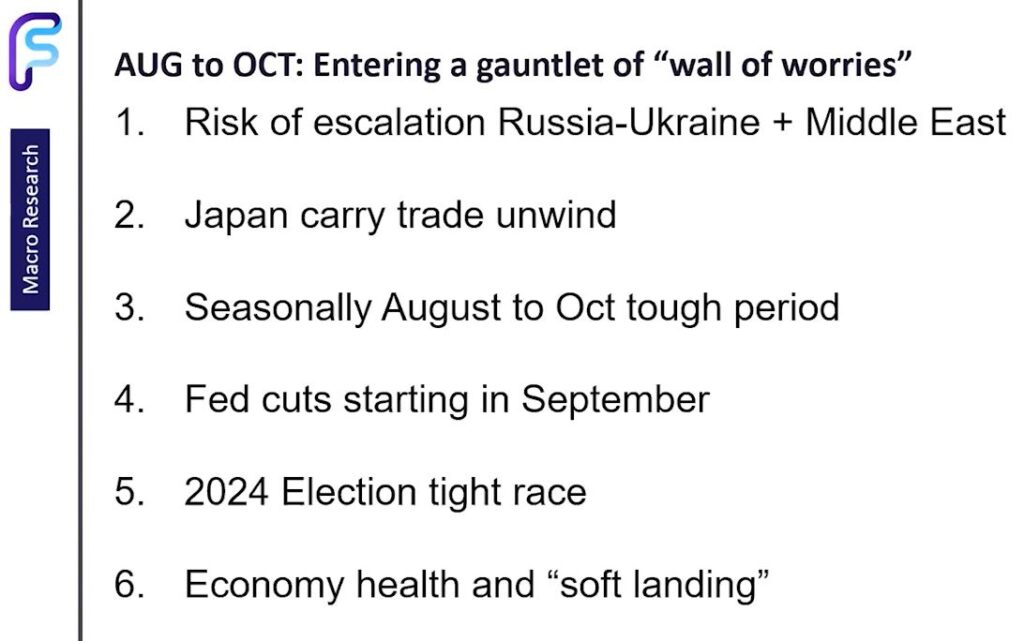

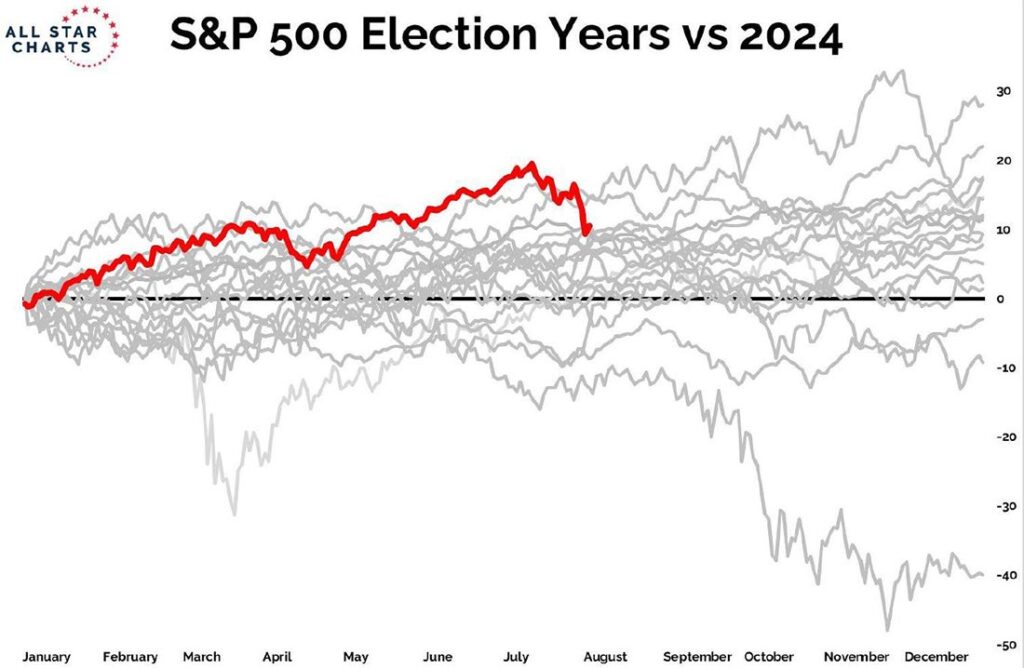

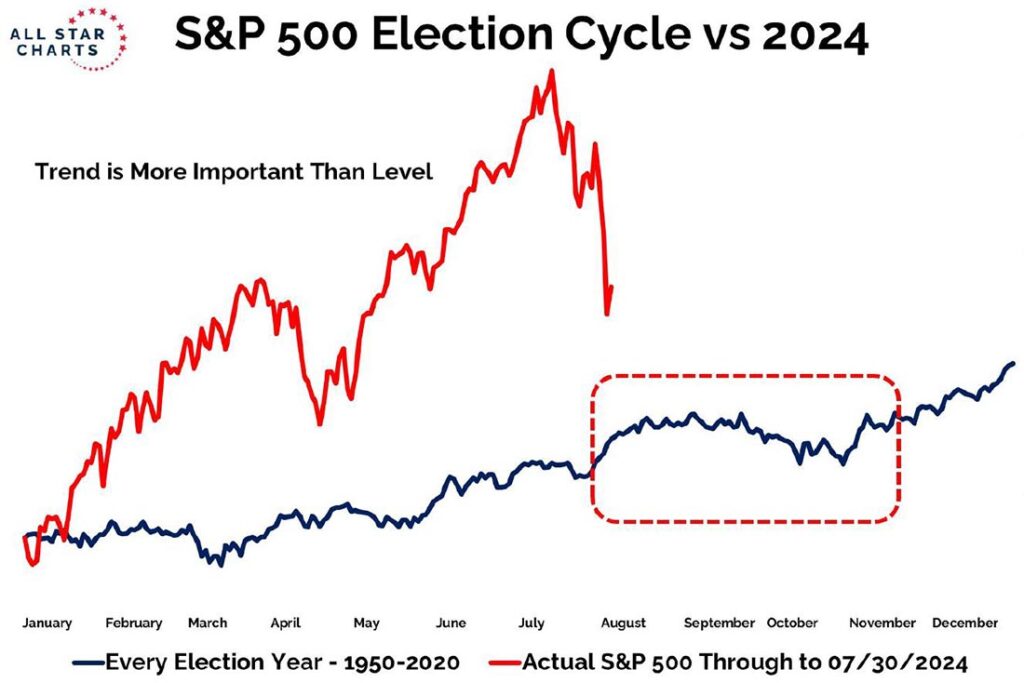

As Ron Burgundy (from the movie, Anchorman) said, “Well, that escalated quickly.” Monday, August 5th, saw the third highest volatility measure on record. The guys discussed that the unwind of an esoteric hedge fund strategy – the “Yen Carry Trade” – was the powder keg on that Monday, after some softening data was reported in the prior week. The Market opened down 6% or 7%, but closed the day less than half that bad… and has resumed its bullish behavior since.