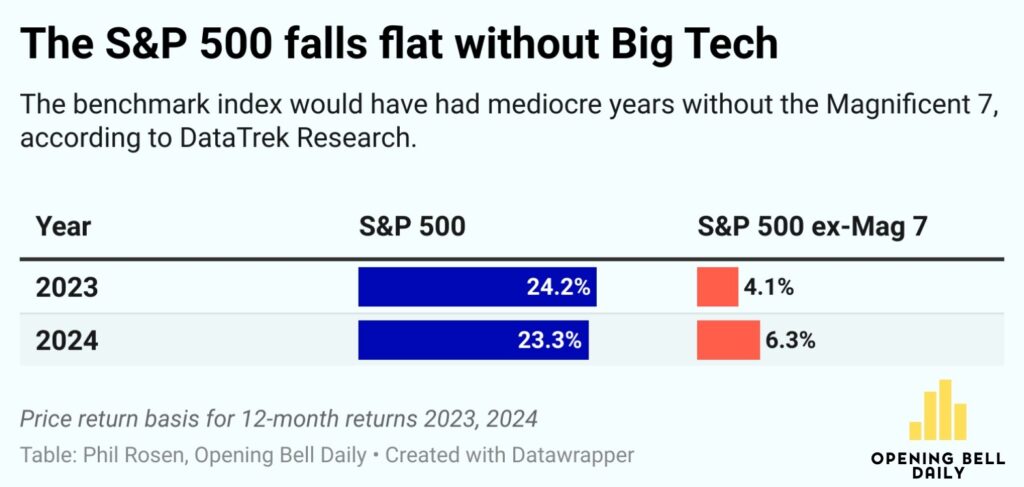

The guys start with a pretty stunning chart showing how the last two years would have looked vastly different if not for the contribution of the Magnificent Seven (ie. Megacap Tech stocks – Apple, Nvidia, Microsoft, Meta (Facebook), Amazon, Google & Tesla). These seven (7!!!) companies have been responsible for 80% of the return of the S&P500 Index return over the last two years. Said differently, 493 companies have only contributed 20% of the growth of the S&P500 over the last two years. Nothing says this concentration trend has to end, but it has been quite unusual… and rather frustrating to those who seek some risk managed returns by way of broader diversification.